I’ve been attentively listening to number of financial specialist such as Ray Dalio, Mike Maloney and Harry S Denton and number of others about the state of the financial world and the demographic time bomb ticking away.

I suppose what has concerned me for long a time is the amount of debt that’s been accumulated firstly to simulate economies after 2008 financial crisis and the covid financial stimulants.

Ray Dalio says financial and economics go through cycles of growth then economic bust! He has written extensively about this and is a regular blogger on LinkedIn and YouTube.

Ray Dalio downloaded his book on Principles for business & Life on LinkedIn chapter at a time.

Ray is humble type of guy but very professional and systematic with his staff and investment strategies. He’s an interesting highly articulate US Hedge fund manager. Bio; Raymond Thomas Dalio is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

He talks about his grave financial concerns of the world economy with likes of Mike Maloney Bio; Mike Maloney is CEO and founder of GoldSilver.com, and widely recognized as a leading expert on monetary history, economics, and precious metals. He is the author of Guide to Investing in Gold and Silver, the best-selling precious metals investment book of this century, I have copy of Rays and Mikes books found them both extremely interesting and informative. Both say definitely do not hold your saving in currency or cash money.

Mike like Ray is a very savvy intelligent financial expert; he wrote a Seminal work on his guide to investing in gold and Silver and the cyclical nature of financial markets.

Basically Mike is saying that money, and he means “real money” that has an intrinsic value such as gold and silver. Both being precious metals are both finite as a natural resource. Where currencies be it digital or paper are not real money but IOU which are promissory notes.

Promissory notes; is a signed document containing a written promise to pay a stated sum to a specified person or the bearer at a specified date or on demand.

Now at one time gold and silver coins were always used as money for the currency of exchange. Coins in circulation had to be checked weighed and inspected to see if they weren’t being debased at all. Near the end of the Roman Empire the emperors were debasing money constantly and using different alloys to debase or reduce their intrinsic values by mixing the coins with copper for instance. But this has always been done by unscrupulous kings time immoral.

The US dollar prior to 1971 was underpinned or supported by gold bullion kept at Fort Knox US army base for storage of gold bullion based in Kentucky. President Nixon or “tricky dicky” as he was nicked named had to stop the international convertibility of the US dollar to gold due what he said to “speculators”.

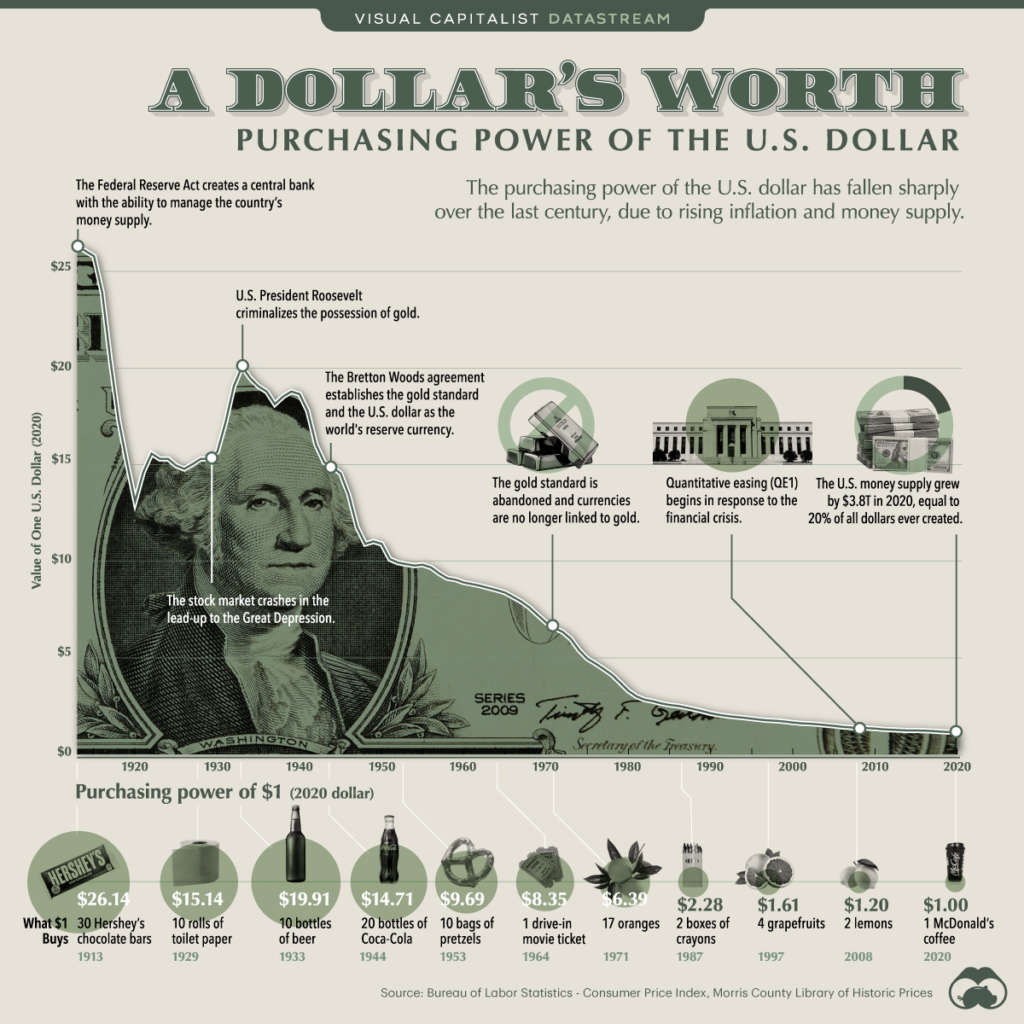

Purchasing Power Of US Dollar

Why did that happen you might ask? Well it goes back to system devised near the end of world war 2 called; The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japanafter the 1944 Bretton Woods Agreement.

The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained its external exchange rates within 1 percent by tying its currency to gold and the ability of the International Monetary Fund(IMF) to bridge temporary imbalances of payments.

Also, there was a need to address the lack of cooperation among other countries and to prevent competitive devaluation of the currencies as well.

More importantly the US dollar became the currency of choice in the international financial world or reserve currency of choice. But why it became that stalwart of financial probity it was simply backed up by gold bullion sitting in Fort Knox.

Gold being a precious metal has real intrinsic value. It’s a commodity. Not a paper IOU. Which is not only admired for its gold coloured luster, it can be made into beautiful jewellery. Today it’s used extensively in electronics and aerospace industries being a noble metal it’s non corrosive non reactive to other elements and has other wonderful properties such as ductility and high electrical conductivity.

Why did the Nixon remove the convertibility of gold to the US dollar you might ask? This is why I believe the present “Fiat”financial currency system is so flawed and dangerous.Which I’ll come back to later.

Nixon Shock and the Bretton Woods Agreement

Anxiety eventually crept into the foreign exchange market, with traders abroad fearful of an eventual dollar devaluation. As a result, they began selling USD in greater amounts and more frequently. After several runs on the dollar, Nixon sought a new economic course for the country.

Nixon’s speech was not received as well internationally as it was in the United States. Why? because his whole speech was bullshit thats why? Many in the international community interpreted Nixon’s plan as a unilateral act against their economies which it was!

Let’s try simplifier the above for you? After the expensive US Vietnam war US finances weren’t good. Other countries were concerned about dollars devaluation so they wanted to exchange their US dollars for gold or real money not paper currency. There was run on gold bullion from Fort Knox this exacerbated the US dollar monetary problems. Nixon said it was to do with speculators not true it was other world governments who’d lost confidence in the intrinsic value of the dollar. Remember it’s only a promissory note just an IOU! Or a promise, remember its a promise no less no more.

Fiat Money; “inconvertible” paper money made legal tender by a government decree. Remember that’s all it is. It’s a currency not money, money has to have an intrinsic value such as gold and silver which is a commodity.

Currency purchasing power since 1971 which is not underpinned by gold has significantly declined. However the US dollar has been slowly declining as the US debt ceiling keeps on increasing which it’s now 30 trillion dollars. $30,000,000,000,000. Phenomenal amount of money.

US President Roosevelt in 1930 criminalised the holding of gold assets. Since the Bretton Woods gold standard agreement the purchasing power of the dollar has plummeted alarmingly!

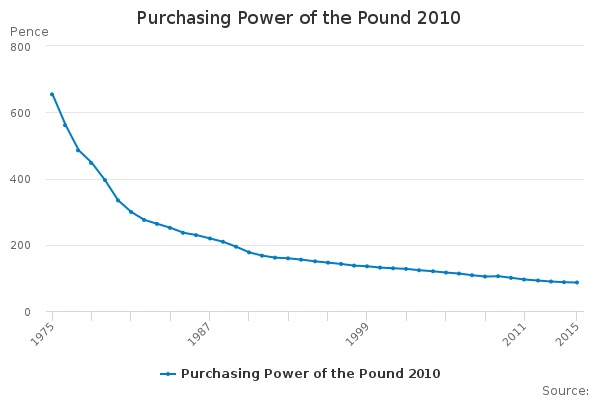

UK Pound Purchasing Power

When you look at graphs of the purchasing power of currencies they are constantly declining. What does that mean in reality for us all? We get poorer and poorer especially if wages are stagnant. My step dad was an American citizen he worked for the United States Lines as a seaman. In the late 1950’s the exchange rate for the US dollars to U.K. pound sterling was 4:1 in US dollar favour.

Mum being married to an American National in real terms was more wealthy then her english neighbours. I know that because our family moved from council “state” house to private bought house.

Currency purchasing power has been diminishing constantly by government decree. Currency isn’t anchored to money 💰remember real money is gold or silver. This is the problem we have is similar to the old Roman emperors who kept debasing money gold coins. Hence the decline in their empire. All empires fail through lack of money or natural resources. Printing money to excess just pumps up assets such as houses, stocks and shares. It’s currency not being used productively in the economy.

Quantitive easing is now the first line of defence with Fiat currency. Let’s use a simple analogy of a concentrated orange juice. You pour it into a glass and you add water to dilute it. But if you put too much water in it eventually becomes water and not orange juice.

Quantities Easing; (QE) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment. Buying these securities adds new money to the economy, and also serves to lower interest rates by bidding up fixed-income securities. It also expands the central bank’s balance sheet.

Basically it’s a “slight of hand” transaction it currency made out of thin air. Today currency has been digitised which makes it even easier to produce for any bank balance sheet.,

The whole banking system is designed to create or maximise debt. What is debt a form of servitude! Servitude; the state of being a slave or completely subject to someone more powerful such as a bank! What Banks have done is made money or currency such a complicated structure its all slight of hand or a fraud on the people? Why?

Because currency is worthless and backed by a promise to pay. If the bank or the government goes bust “hay presto” it currency purchasing power goes down and everything seems to get alot more expensive and the currency becomes worthless.

Remember currency is an IOU so it wasn’t real in the first place. But one big governmental scam as governments keep maintaining this illusion that paper currency has real value but as I’ve stated its constantly being devalued because of poor central bank management. But if currency such as the dollar or the pound eventually becomes worthless, what then? No amount of currency printing will rectify the problem. Because paper currency is paper with no fiscal backing such as gold so technically its worthless with no intrinsic value. all built on confidence or really one big “confidence trick”.

Why is it wages have been stagnating for the past 20 years because governments keep pushing currency into the financial system by the trillions and trillions of Dollars, Pounds and Euros and it simply dilutes the purchasing power of the currency. But inflation is higher than government like to tell us. How do we know that? Because prices keep rising and they fabricate the consumer price index to make inflation look lower than it really is. In fact its not actually inflation of goods but the reduction of purchasing power of the currency. all an illusion! blame covid or european union or anyone else but the banks.

Since 2008 and the near economic crash the leading world economies have been on life support with zero interest rates, massive accumulated debt and housing and stock market bubbles.but the banks keeping making loads of money profits are at all time highs.

Today we have real inflation and governments are starting to rise taxation through National Insurance contributions which is a stealth way of taxing us and companies. Stealth are government modus operandi. What now?

In reality what’s really happening is currency devaluing due to excess currency supply. Latterly over the past two years it’s accelerated out of control. looking at the graphs currency is in free fall and its purchasing power.

This is the scary part of todays economic system. All the expert financiers such Ray Dalio and Mike Maloney think something bad is around the corner. Something far worse than the 1930’s financial crash! Look at the present financial situation in Lebanon and Turkey with inflation could very easily happen here in the so called western industrialised countries.

But we all know we have existential threat of the biosphere with the climate getting out of its current equilibrium to a new equilibrium which might not be so conducive to human existent. The other significant and real threat for GDP’s of economies is the reduction in population size. How do I know that simply by the number of children being born. World Fertility rates 1950 average was 5 per woman 2022 it was 2.4 and reducing as women become more educated and emancipated.

I believe all systems be they financial, economic, population and environmental will force us to change. What do I mean by forced change it will be out of our control suddenly like a tipping point it will change radically to a new paradigm.

This present economic system of growth consumerism and high energy living will have to change. It will be very painful process but we have no choice like the western Roman Empire collapsed the banking currency system isn’t working.

There were number of reason why the western Roman Empire collapsed it got too big and complicated and corrupt. But I believe it was down to the finances and the debasement of money. As both Ray and Mike state things come around in cycles and repeat themselves but in slightly different guises.

But as I previously stated we have so many existential threats that governments and central banks don’t have the answers because they’ve run out of tools in the tool box. When we get the Bank of England govern who’s on a wage of £500,000 per year telling working poorer people not to demand wage rises you know they and we have a problem.

As Mike says make sure your savings are not in cash but in tenable commodities like gold and silver. And don’t have those commodities in conventional vaults either, why? In the time of financial crisis the governments can grab your gold and silver. Have the power to bring in all types of decrees. Stop you taking your currency and gold out of the country, bring in all types of other financial restriction.

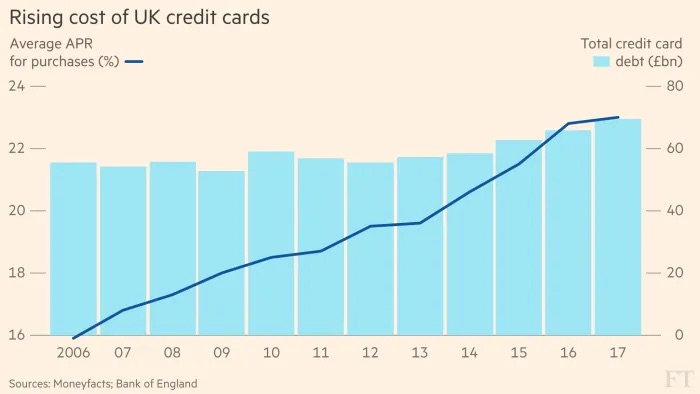

Finally debt = money that’s how banks make exorbitant profits through debt lending look at the current rate of interest on credit cards if you don’t clear your expenditure each and every month the APR annual percentage rates are ridiculously high.

Bank saving rates are virtually zero for savers, whereas credit card rates are 20% + and 5 year personal loan of £ 5000 and under is at 8% apr. That’s relatively low interest rate. What about if you have poor credit ratings? Loans interest rates absolutely skyrocket!

For all banks Debt = Money but as Mike Maloney states real money is a commodity such as gold & silver and paper money is promissory note IOU and not money but currency. Got it! Basically currency stimulation makes the populace poorer and the banks and super rich richer. Purchasing power dilutes meaning you feel poorer. So it’s hidden form of central bank theft from all of us to keep a flawed currency system going. Growth of products equals growth in debt. Both for the populace and the nation as a whole. Because central banks quantitive easing makes us all that much poorer and more in debt. Having a Fiat fractional reserve banking currency not linked to any real commodity such as gold allows central banks and government to rack up massive debts for each and every one of us. Eventually the nations of the world will go bankrupt! All the financiers keep saying this present situation can not go on for ever and one day soon their will be a painful reckoning. Very painful! Maybe then we’ll have go back to sound money?

Attention Warming I’ve included this video from Andrew Taggart about the bull whip effect. The US Federal Reserve scrambling to get to grips with inflation? It has no tools in the tool box. Base rates will have to go up and quickly otherwise economies will move into hyperinflation mode. God know what will happen then serious situation for financial economics. The world has become far too complex for anyone to control be they individuals, companies and nations. Central banks are always behind the curve. Like the weather / climate anything we do to change its equilibrium like financial markets causes havoc. Like financial stimulus central banks are tinkering with complex financial system I think this tinkering has brought us to an unstable financial “fiat IOU digitised” banking world that could suddenly go into free fall.

Finally why do we all put up with this big con? can anyone answer that for me please? Financial system that keeps the poor poor and the rich rich!

https://podcasts.apple.com/gb/podcast/analysis/id267300806?i=1000551087331

Analysis Inequality